What is a Financial Consultant?

From investment planning to cash flow analysis, a financial consultant delivers customized wealth guidance to meet your specific objectives. At Omega Wealth Management, our financial consultants provide advanced resource management strategies. We work with individuals, business owners, and entrepreneurs across the country and maintain expert knowledge in federal financial regulations. As financial consultants, we offer 1:1 executive coaching, asset analysis, retirement planning, estate planning, and referrals to helpful resources. Set up a free 15-minute conversation to learn more.

When to Utilize a Financial Consultant

Our financial consultants are committed to supporting the goals that are most important to you. Clients may utilize a financial consultation at any point in life, including scenarios like:

- Starting an entrepreneurial endeavor

- Buying or selling a business

- Preparing for retirement

- Developing a financial legacy

- Restructuring your current portfolio

We take the time to identify your fundamental values, financial needs, and long-term intentions before creating a customized solution. Take the first step today and set up a consultation with our team.

Business Planning

- Evaluation of strengths, assets, and goals

- Investment planning

- Tax planning & strategy

Family Wealth Management

As your family grows and changes, your financial needs change too. Our financial consultants can help you navigate these transitions with estate planning, retirement advice, asset management, and investment guidance. Whether you have recently received an inheritance or are welcoming a new member to the family, a financial consultant can ensure that you and your loved ones are on track for economic well-being. Our engagement always begins with a detailed consultation to establish where you are now, where you want to be, and all of the steps in between. A financial consultant acts as a trained “thinking partner” to create a solid financial plan for the road ahead. Our financial consultants can provide support with:

- Estate & trust planning

- Retirement planning

- Financial preparation for marriage, divorce, and children

- Charitable gifting strategy

Take a look at our Transition Navigator™ service for more information on our process.

Financial Consultant Services

Omega Wealth Management has developed financial consulting services to support what’s most important to you. Whether your career or personal circumstances are in transition, our financial consultants can construct a written plan that will give you peace of mind and renewed inspiration. Our plans always include a sound investment strategy backed by a world-class investment platform that aligns with your goals. Our signature services include:

The Life + Wealth Navigator™

The Life + Wealth Integrator™ is a multi-meeting experience centered around your goals, values, and approach to decision-making. We start with a conversation to establish your values, vision, and current investments. We also discuss potential obstacles or transitions down the road. As part of this service, you will receive a written plan that incorporates all areas of your financial life: cashflow, taxes, retirement, investment, insurance, college education, and estate planning. Omega Wealth Management will then work with you to execute this plan, recommend resources as needed, and meet at least twice a year to ensure success.

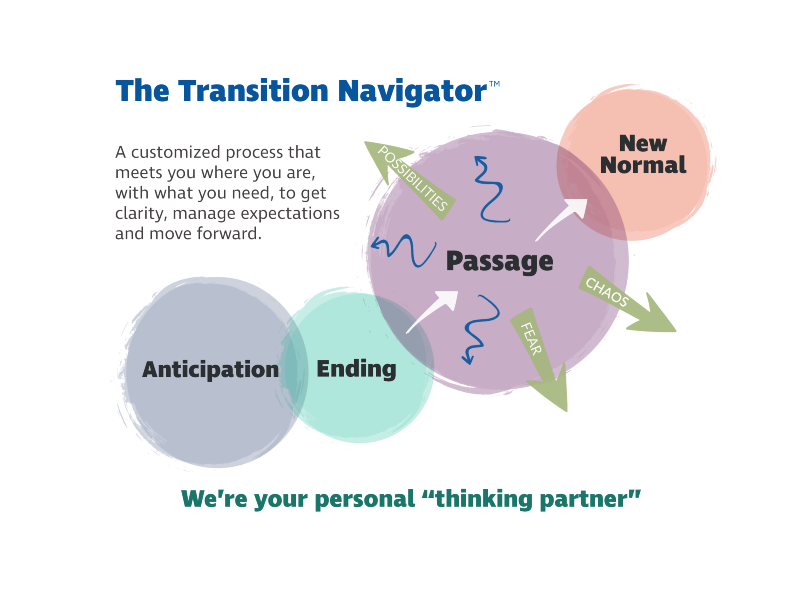

Transition Navigator™

The Transition Navigator™ tool was developed for individuals undergoing significant personal and financial transitions. In this model, a financial consultant acts as your “thinking partner”, helping you navigate decision-making amidst uncertainty. We begin by assessing where you are now, the changes you are anticipating, and what your “new normal” will look like. Our program is tailored to your timeline, values, and perspective. We take the process at your pace while helping you build a solid financial plan to support you in the future.

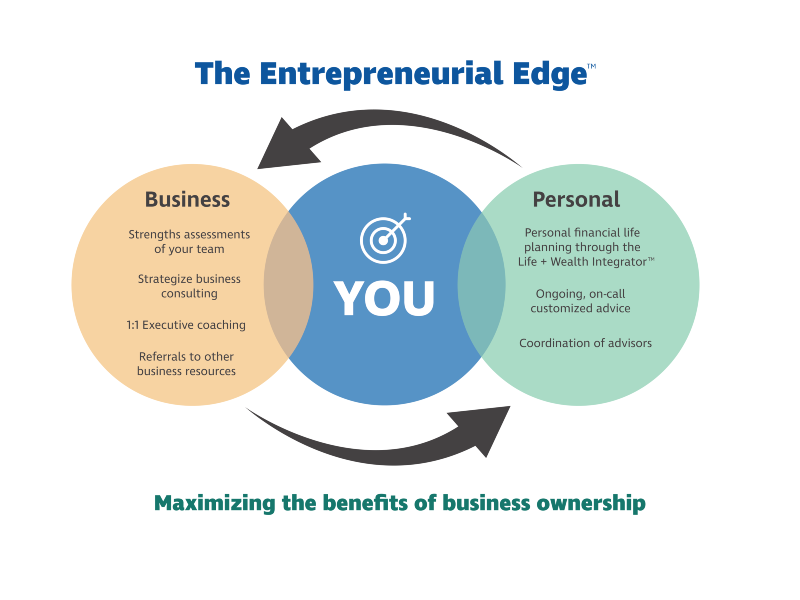

The Entrepreneurial Edge™

The Entrepreneurial Edge™ is a service for business owners and entrepreneurs. It is designed to holistically integrate your personal and business financial well-being. Our financial consultants customize the plan with your unique needs and business goals in mind. We start with a discussion of your values. From there, we craft a plan that integrates the personal and business sides of your life. In addition, this service includes exercises and assessments to help you maximize the benefits of owning a business. You will have access to monthly calls with your financial consultant, as well as referrals to specialists as needed. Start learning today with information on our Resources Page.

The Consultation Process

- Build a picture of your current financial strengths and weaknesses

- Establish short-term and long-term goals

- Review current and future financial commitments

- Discuss market assumptions and possible challenges

- Plan ahead for life transitions

Our Team

- Certified Professional Facilitator (CPF™)

- Registered Life Planners (RLP®)

- Certified Financial Transitionist (CeFT®)

- Certified Financial Planner (CFP™)

- Certified Investment Management Analyst (CIMA®)

Ready to start your financial planning journey?

Ready to start your financial planning journey? Connect with our team in a free 15-minute call today.

Just for You

Knowledge is power! Stay up to date with the latest tips, tricks, and trends that people in the know use to make the most out of what they’ve got.